In the intricate world of commerce, success is not merely defined by sales volume or revenue. The true measure of a product’s financial viability and a company’s health often lies beneath the surface, in a key metric known as product margin. This fundamental concept serves as the bedrock for pricing strategies, operational decisions, and long-term sustainability. Unlike promotional content, this guide is designed to provide a comprehensive, objective exploration of product margin—what it is, why it matters, and how it is applied in real-world business analysis. By demystifying this crucial indicator, businesses and individuals can make more informed, data-driven decisions that focus squarely on genuine profitability.

What is Product Margin? A Core Financial Metric Defined

Product margin, often referred to as gross margin at the product level, is the financial measure that reveals the profitability of an individual item sold. It represents the difference between the revenue generated from selling a product and the direct costs specifically associated with producing or acquiring that product. Crucially, it is expressed as a percentage of the revenue. This metric isolates the profit potential of the product itself before accounting for broader company-wide expenses like marketing, rent, salaries for administrative staff, and utilities. In essence, it answers the question: “After covering the direct costs of this specific item, what percentage of the selling price remains to contribute to covering overhead and generating net profit?”

The Direct Costs: Cost of Goods Sold (COGS)

To understand margin, one must first understand its counterpart: Cost of Goods Sold (COGS). These are the direct, variable costs tied to the production or procurement of a specific product. They typically include:

-

Raw Materials: The physical components that make up the product.

-

Direct Labor: Wages for employees directly involved in manufacturing the item.

-

Manufacturing Overhead: Factory utilities, equipment depreciation for production machinery, and direct factory supplies.

-

Purchase Cost: For retailers and resellers, this is simply the wholesale price paid to acquire the product.

Importantly, COGS excludes fixed operational expenses like distribution, sales force salaries, or executive compensation. The clarity of this distinction is what makes product margin such a powerful analytical tool.

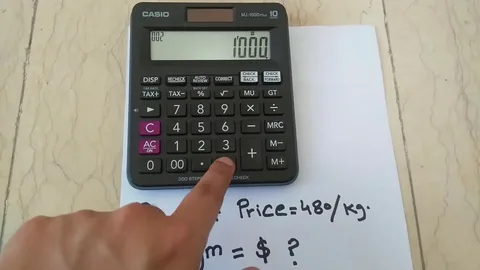

How to Calculate Product Margin: The Essential Formulas

The calculation of product margin is straightforward but must be applied consistently. There are two primary forms: the monetary amount and the percentage.

1. Calculating Gross Profit per Unit (Dollar Amount)

This is the simple difference between the unit’s selling price and its direct cost.

Gross Profit = Selling Price per Unit - COGS per Unit

Example: A book sells for $25. It costs $10 to print and bind. The Gross Profit is $25 - $10 = $15.

2. Calculating Product Margin Percentage

This is the more insightful figure, as it allows for comparison across products of different price points.

Product Margin % = [(Selling Price per Unit - COGS per Unit) / Selling Price per Unit] x 100

Using the same example:

[($25 - $10) / $25] x 100 = ($15 / $25) x 100 = 60%

This means 60% of the revenue from each book sale, or $15 out of every $25, is retained as gross profit to cover other expenses.

Margin vs. Markup: A Critical Distinction

A common point of confusion is the difference between margin and markup. While related, they are calculated differently and provide different perspectives:

-

Margin (as defined above) is the percentage of profit based on the selling price.

-

Markup is the percentage added to the cost price to arrive at the selling price.

Markup % = [(Selling Price - COGS) / COGS] x 100

In our example, the markup is[($25 - $10) / $10] x 100 = 150%. A 60% margin equals a 150% markup. Confusing the two can lead to severe pricing and profitability errors.

Why is Product Margin Analysis Non-Negotiable for Business Strategy?

Analyzing product margins transcends basic accounting; it is a strategic imperative. It provides an unambiguous lens through which to view business performance.

Informs Strategic Pricing Decisions

Margin analysis is the cornerstone of effective pricing. It helps determine the minimum viable price point to maintain profitability. Businesses can model how discounts, promotions, or bulk pricing affect the bottom line at the product level before implementing them.

Drives Product Portfolio Management

Not all products are created equal. Through margin analysis, businesses can categorize their offerings:

-

High-Margin Stars: Products to promote and protect.

-

Low-Margin Volume Drivers: Products that may attract customers but contribute less per unit.

-

Loss Leaders: Intentionally low-margin products designed to stimulate sales of higher-margin items.

This analysis guides decisions on which products to develop, emphasize, or discontinue.

Enhances Cost Control and Negotiation

A clear view of product margin highlights the impact of COGS. If a product’s margin is shrinking, it directs attention to supply chain inefficiencies, rising material costs, or production bottlenecks. This data empowers negotiations with suppliers or prompts a search for alternative materials.

Enables Accurate Financial Forecasting and Goal Setting

By understanding the aggregate margin of the product mix, leadership can project overall gross profit more reliably. This is essential for setting realistic sales targets, budgeting for operational expenses, and forecasting net profitability.

Gross Margin vs. Net Profit Margin: Understanding the Hierarchy of Profitability

It is vital to place product margin within the broader hierarchy of profitability metrics.

-

Product/Gross Margin: Revenue – Direct Costs (COGS). Focuses on product efficiency.

-

Operating Margin: Gross Profit – Operating Expenses (Rent, Marketing, R&D). Focuses on operational efficiency.

-

Net Profit Margin: All Revenue – All Costs (including taxes and interest). Focuses on overall business efficiency.

A strong product margin is the first essential step toward a healthy net profit, but it does not guarantee it. High product margins can be eroded by excessive operating expenses.

Key Factors Directly Impacting Your Product’s Margin

Several internal and external variables influence this critical metric.

Fluctuations in Cost of Goods Sold (COGS)

This is the most direct factor. Increases in raw material prices, labor wages, or import tariffs will compress margin if the selling price remains constant.

Pricing Strategy and Competitive Pressure

Market forces heavily influence the achievable selling price. Intense competition can drive prices down, squeezing margins. A company’s brand positioning—whether as a budget or premium provider—also dictates its pricing power.

Product Lifecycle Stage

Margins often evolve through a product’s life:

-

Introduction: Margins may be lower due to high initial production costs and promotional pricing.

-

Growth: Margins typically improve as sales volume increases and unit costs potentially decrease (economies of scale).

-

Maturity: Margins may face pressure from competition and market saturation.

-

Decline: Margins can shrink as sales fall and inventory management becomes costly.

Economies of Scale and Operational Efficiency

As production volume increases, the fixed portion of COGS per unit often decreases. Bulk purchasing of materials and optimized manufacturing processes can significantly improve per-unit margins.

Industry Benchmarks: What is a “Good” Product Margin?

There is no universal “good” margin. It varies dramatically by industry, business model, and cost structure.

-

Retail (Grocery): Often operate on very thin margins (2-5%) but rely on extremely high volume and fast inventory turnover.

-

Software/SaaS: Can have exceptionally high margins (70-90%+) after development, as the cost to reproduce a digital product is near zero.

-

Manufacturing: Margins vary widely based on complexity, from modest (10-15%) for simple goods to high (40-50%+) for specialized equipment.

-

Consulting/Services: Margins can be high (25-50%) as the primary COGS is often just the time of highly skilled labor.

The key is to benchmark against your specific industry and to track your own margin trends over time.

Practical Applications: Using Margin Data for Smarter Decisions

Product Line Rationalization

Analyze margins to identify underperforming products that drain resources. A product with a negative or chronically low margin might need a price increase, a cost redesign, or discontinuation.

Sales Channel Analysis

Calculate margins by sales channel (e.g., online store, wholesale, direct sales). You may discover that while wholesale volume is high, the margin is much lower than direct-to-consumer sales, influencing channel strategy.

Customer Profitability Insights

In B2B or contract manufacturing, margin analysis can be applied to specific customers or contracts. Some customers may demand customizations or services that erode the standard product margin, necessitating adjusted pricing.

Common Pitfalls and Misconceptions in Margin Calculation

1. Inaccurate or Incomplete COGS

The most frequent error is underestimating COGS. Failing to include all direct labor, shipping to receive materials, or packaging can inflate margin calculations, leading to strategic missteps.

2. Confusing Margin with Markup

As discussed, pricing based on a target markup percentage will yield a different (and lower) margin percentage, potentially under-pricing products.

3. Ignoring the Impact of Discounts and Returns

A product’s theoretical margin can be drastically different from its realized margin after accounting for seasonal discounts, promotional offers, and return rates. Effective analysis must factor these in.

4. Overlooking Contribution to Overhead

A product with a modest 15% margin that sells in enormous, steady volume may contribute more total gross profit dollars to cover overhead than a niche product with a 40% margin that sells only a few units per month.

Advanced Concepts: Contribution Margin

For more nuanced decision-making, particularly regarding short-term tactics or constrained resources, businesses may analyze Contribution Margin. This metric subtracts all variable costs associated with the product (which can include sales commissions or transaction fees beyond COGS) from revenue. It answers: “How much does selling this one additional unit contribute to covering fixed costs and generating profit?” This is especially useful for evaluating special orders or pricing during sales slumps.

Conclusion: Margin as a Compass, Not Just a Number

Product margin is far more than an entry on a financial statement. It is a dynamic, insightful compass that guides fundamental business decisions. From setting a sustainable price to curating a winning product portfolio and negotiating with suppliers, a deep, accurate understanding of product margin provides the clarity needed to navigate competitive markets. While a healthy net profit is the ultimate destination, achieving it is impossible without first mastering the art and science of margin management. By consistently monitoring, analyzing, and strategically acting upon margin data, businesses shift from operating on intuition to steering with financial precision, thereby building a more resilient and profitable foundation for growth.

Frequently Asked Questions (FAQs)

Q1: What is the difference between product margin and profit?

Product margin (gross margin) is a specific type of profit calculated at the product level (Revenue – Direct Costs). “Profit” is a broader term; net profit is what remains after all expenses, including overhead, taxes, and interest, are subtracted from total revenue. Margin is a subset and contributor to overall profit.

Q2: How can I improve my product margins?

Improvement levers generally fall into two categories: Increase Price (enhance value perception, target new markets) or Reduce COGS (negotiate with suppliers, improve production efficiency, streamline logistics). The optimal strategy depends on your market position and competitive landscape.

Q3: Is a higher product margin always better?

Not necessarily in isolation. An extremely high margin might indicate under-pricing or a lack of competitive pressure, but it could also make the product a target for competitors. The goal is a sustainable margin that supports business growth while delivering customer value. Total gross profit dollars (margin % x volume) is often a more important figure.

Q4: How often should I calculate and review product margins?

Best practice is to review margins at least quarterly. For businesses with volatile material costs, fast-moving industries, or during the launch of a new product, monthly or even per-batch reviews may be necessary. Regular review helps identify trends and react promptly.

Q5: Can a product have a high margin but still be unprofitable for the company?

Yes, absolutely. If the operating expenses (marketing, R&D, administration) required to support and sell that product are excessively high, they can consume the gross profit it generates, leading to a net loss. This is why analyzing all levels of profitability is critical.